Prefeasibility Study

On August 20, 2014, Atacama Pacific announced the results of a Prefeasibility Study (“PFS”) for the Cerro Maricunga oxide gold project following up on the Preliminary Economic Assessment published on January 12, 2013. The PFS demonstrated the economic viability of an open pit and conventional heap leach operation at Cerro Maricunga as highlighted below:

- Average annual production over the first 8 years of 281,000 gold ounces

- 2.96 million recoverable gold ounces over a 13 year mine life

- Average cash costs of $683 per ounce

- Initial capital costs of $398.9 million with sustaining capital of $187.6 million

- Strong total operating cash flows of $1.27 billion at $1,350 per ounce gold (“/oz Au”)

PEA Technical Highlights

| Mine Type |

Open Pit |

|

Mine Life |

13 Years |

|

Life of Mine Reserves |

294.4 M tonnes |

|

Life of Mine Gold Production |

2.96 M ounces |

|

First 8 Years Average Production |

281,000 ounces |

|

Life of Mine Average Gold Production |

228,000 ounces |

|

Average Gold Grade |

0.40 g/t |

|

Processing |

Conventional Heap Leach |

|

Daily Throughput |

80,000 tonnes |

|

Strip Ratio (Waste: Ore) |

1.76:1 |

|

Crush Size |

19 mm (3/4 in) |

|

Gold Recovery |

79.2% |

|

Life of Mine Cash Costs |

US$ 683/oz Au |

|

Initial Capex |

$389.9 M |

|

Sustaining Capital |

$187.6 M |

| Chilean Tax Rate |

20% |

Top

Economic Analysis

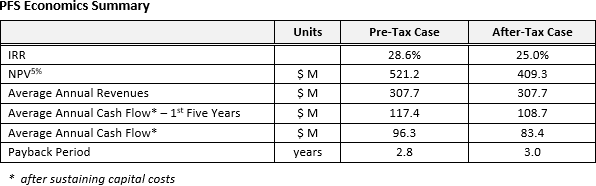

The PFS calculates a base-case after-tax NPV at a 5% discount rate of US$409.3 million with an after-tax IRR of 25.0% and an average pre-tax cash flow from operations of US$108.7 million over the first 8 years of operation. See the table below.

The following operational parameters and costs were used in the PFS:

| |

• |

Processing Rate: |

80,000 tonnes per day |

| |

• |

Gold Recovery: |

79.2% |

| |

• |

Average Mining Cost: |

$1.40 per tonne mined |

| |

• |

Processing costs: |

$2.52 per tonne processed |

| |

• |

General and Administration: |

$0.54 per tonne processed |

| |

• |

Gold Price: |

$1,350/oz Au |

Top

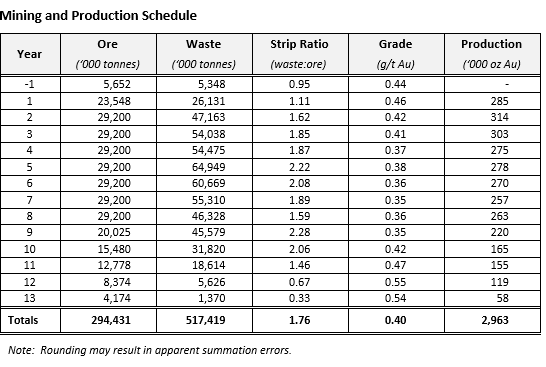

Mining and Processing

Projected total gold production over the projected 13-year mine life is 2.93 million ounces at an average operating cash cost of $683/oz Au. Gold production begins to decline in Year 9 as the mining activities increase in depth in the pit; however, the reduction in mined ore is partially offset by increasing gold grades at depth. Approximately 294.4 million tonnes of ore grading 0.40 g/t gold will be mined through open pit methods and processed on a conventional heap leach pad. An average life of mine strip ratio of 1.76 to 1 (waste to resource) was calculated.

Conventional open pit mining methods have been considered in mining the Cerro Maricunga deposit. The PFS considers utilizing a maximum fleet of,

- 17 290-tonne haul trucks (Komatsu 9300E–4SE),

- 4 42-cubic metre hydraulic shovels (Komatsu PC8000),

- 5 production drills (Atlas PV 275),

along with various ancillary equipment to achieve the maximum annual total ore and waste movement of 94 million tonnes. The PFS takes into account that the mining fleet will be leased and Atacama Pacific has received a proposed lease agreement.

The Mining and Process Schedule is provided below.

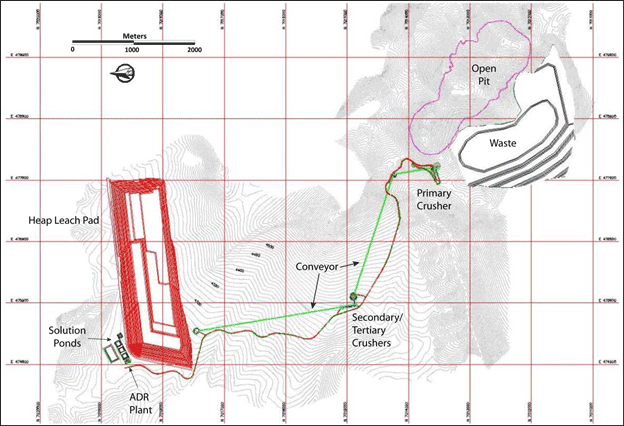

Cerro Maricunga Operations Plan, 2014 PFS

Processing

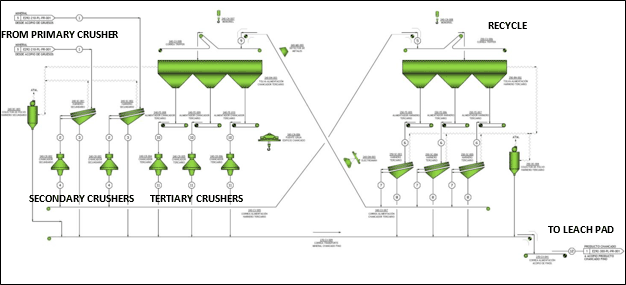

Oxide mineralization will be trucked to a primary gyratory crusher facility (METSO MK II 62” x 75”), located immediately west of the pit boundary where it will be crushed to 165 millimetres (“mm”). The primary crushed material will then be conveyed approximately 2.9 kilometres (“km”) to feed two secondary cone crushers (METSO MP 1000) and three tertiary cone crushers (METSO MP 800). The final crushed product, measuring (P80) 19 mm, will be conveyed 2.4 km to the heap leach pads.

Crushed material will be stacked on the heap leach pad by a radial stacker in 50 by 50 m modules in layers 10 m thick. The final leach pad height will be approximately 100 m. A pad irrigation rate of 10 liters/hour/metre2 has been considered. NaCN and lime consumption are expected to be 0.23 kg/t”) and 2.7 kg/t respectively. The cost of consumables was established from recent quotes provided by Chilean-based suppliers. The pregnant leaching solution containing gold will be pumped to a conventional carbon adsorption facility (ADR plant) where gold from process solutions is recovered to a final gold doré product.

Secondary / Tertiary Crushers

Location of Leach Pads

Location of Rock Waste Storage (right) with Phoenix Zone (left)

Top

Capital Requirements

The PFS calcalates capital expenditures for the development of an open pit mining and conventional heap leach processing operation at the Cerro Maricunga project at US$398.9 million, which includes contingencies of US$46.5 million. A breakdown of the capital costs is provided in the table below. Additional capital requirement during the life of the mine, including annual heap leach pad expansions and closure costs total US$187.6 million, which includes a 15% contingency. The capital costs presented are based on quotes received from equipment manufactures or contractors.

Summary of Initial Capital Expenditures1 *

|

Item |

US$ (millions) |

|

Mine |

|

|

Pre-strip |

15.3 |

|

1st Fleet Lease Payment |

7.5 |

|

Mining Support |

19.6 |

|

Processing |

|

|

Primary Crushers & Stockpile |

34.2 |

|

Secondary Crushers |

18.0 |

|

Tertiary Crushers |

20.5 |

|

Tertiary Screening Plant |

18.3 |

|

Fine Stockpile |

14.5 |

|

Conveyors |

37.8 |

|

Leach Pads |

83.7 |

|

ADR & EW/Smelting |

23.3 |

|

First Fill |

2.0 |

|

Infrastructure |

|

|

Support Facilities |

34.9 |

|

Roads |

10.1 |

|

Owners |

12.7 |

|

Capital Costs (without

contingencies) |

352.5 |

|

Contingencies

(15%)2

|

46.5 |

|

Total Capital |

398.9 |

1. The PFS was completed to a level of accuracy of +20%

to -5%

2. Contingencies are 15% of capital costs excluding "Mine" costs

Leasing

The PEA assumes, on the basis of quotes received, that the mining fleet will be acquired through a manufacturer lease arrangement for a total cost of US$234.4 million. The quote is for a lease period of 5 years for the drilling/loading/hauling fleet with a final payment in following year for the purchase of the fleet. The auxiliary equipment lease is for a period of 3 years with a payment in the fourth year for final purchase.

The construction of a truck maintenance shop will be undertaken by ARRIGONI under a $28.4 million leaseback over a period of 13 years.

Atacama Pacific has been provided a letter of intent from ELECNOR, a multinational engineering and construction firm, for the construction and operation of the water supply infrastructure from Copiapó to Cerro Maricunga. The annual cost of the lease is $17.5 million for the first 8 years and declines to $10 million in year 13, reflecting lower ore throughput. The same firm has offered to construct and operate the electrical distribution system at a price of $5 million per year.

Top

National Instrument 43-101 Technical Report

Top

|

|

|

|